Applying for a small business loan with 2UFi

With 2UFi Passport, skip the paperwork – we already have your info!

Just confirm your details and proceed with your loan application. Start, pause, or return at your convenience. If you don’t already a 2UFi account, its easy. Simply complete the application for a 2UFi Business Suite account that includes the 2UFi Passport feature.

Upload documents.

Having your documents ready will speed up the process. The app will guide you through how to upload them. Documents to have ready include:

- Business formation documents

- EIN letters (IRS Form SS-4)

- Business license

- DBA/Trade Name registration, if applicable

- Certificate of Good Standing, if incorporated

Quick review process.

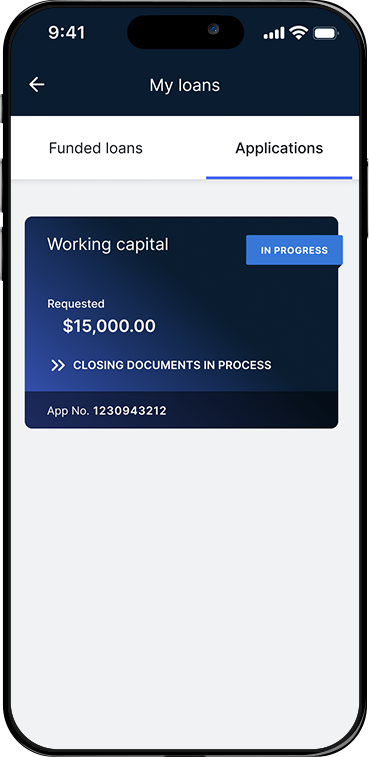

We’ll review your application and keep you updated throughout the process.

2UFi loan FAQs

Why should I consider using 2UFi to apply for a small business loan?

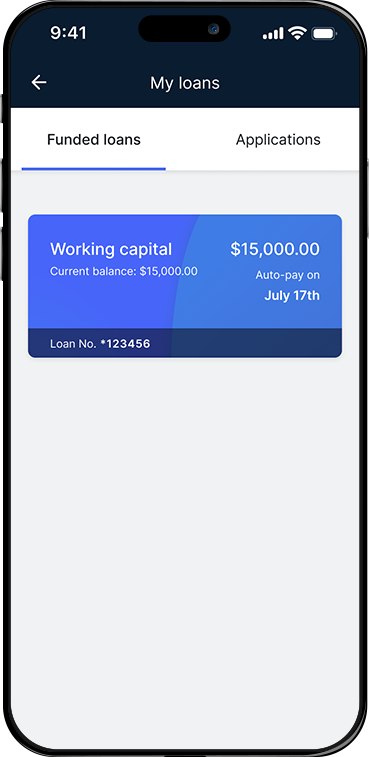

If your business is growing, you need to preserve capital for reinvestment into that growth. 2UFi allows you to easily apply for an SBA 7(a) Working Capital Loan, which allows both lower down payments and longer terms than conventional loans. You can then track your application and access your funds directly in your 2UFi Business Suite.

What kinds of loans can I get on 2UFi?

2UFi allows businesses to easily apply, track, and access funds for an SBA 7(a) working capital loan through the U.S. Small Business Administration (SBA)’s 7(a) loan program and Bank of Jackson Hole Trust, an SBA-preferred lender and member-FDIC bank.

Can I get an SBA loan on the 2UFi platform?

Yes, 2UFi allows you to easily apply for an SBA 7(a) working capital loan, track its progress, and access your funds.

What is the SBA?

SBA stands for U.S Small Business Administration, a government agency that provides support and resources for entrepreneurs and small businesses.

Is it free to apply for a loan with 2UFi?

Yes, it’s free (and easy) to apply for a loan through 2UFi’s platform.

What documents are required to apply for a loan through 2UFi?

Creating your 2UFi Passport makes the loan application process easy. Your information will be auto-filled from your passport into your application. We may also need the following, depending on your type of business:

- Business formation documents

- EIN letters (IRS Form SS-4)

- Business license

- DBA/Trade Name registration, if applicable

- Certificate of Good Standing, if incorporated

Is applying for a loan with 2UFi secure?

Yes, we use bank-level 256-bit encryption, multi-factor authentication, and regular monitoring to keep your data safeYes, we use bank-level 256-bit encryption, multi-factor authentication, and regular monitoring to keep your data safe.

Banking and lending products and services are provided by Bank of Jackson Hole Trust, Member FDIC.