Business Spending

A digital business spending account to manage your money. Operates like a business checking account without paper checks.

Business Savings Sweep

Earn 4.00% Annual Percentage Yield (APY)* nightly with an automatic sweep feature.

2UFi Business Suite

Digital banking suite for entrepreneurs. Get business insights and earn money while you sleep.

About the 2UFi Business Suite***

What is the 2UFi Business Suite?

The 2UFi Business Suite is a smart spending and savings account bundle designed to help your business make the most of every dollar. It includes a 2UFi Spending Account that operates just like a business checking account without paper checks, and a 2UFi Savings Account. They’re connected with an automatic sweep feature that moves excess funds from your spending account into savings—so you earn more without lifting a finger.

How does the automatic sweep feature work?

Every night, 2UFi automatically transfers any spending account balance over $5,000 into your linked savings account, where it earns a competitive 4.00% Annual Percentage Yield (APY*). The next morning, your funds are swept back into your spending account so they’re ready for daily use. It’s savings on autopilot.

Why should I choose the 2UFi Business Suite for my business?

With the 2UFi Business Suite, you can:

- Earn interest automatically with your linked business savings account on swept balances

- Manage your business expenses from one simple, all-in-one application

- Keep funds liquid and accessible for everyday spending

- Access your money anytime with your 2UFi Visa Business Debit Card

Earning and saving automatically

How much can I earn with the 2UFi Business Suite?

You can earn 4.00% APY* on funds over $5,000 that are swept into your 2UFi Savings account. That’s money your business could be earning overnight—automatically.

Do I have to transfer money myself to earn interest?

No. The sweep happens automatically. 2UFi takes care of transferring your extra funds into savings each night and moving the funds back into spending in the morning so you’re always ready to spend when you need to.

Is there a minimum balance required to earn interest?

Yes. The automatic sweep feature activates when your spending account balance exceeds $5,000. Any amount above that threshold earns interest at the current APY.

Opening an account

How do I open a 2UFi Business Suite?

Opening your account is fast and secure. You can get started in just a few steps:

- Sign up on the 2UFi app or at app.2Ufi.com.

- Verify your email and mobile number.

- Complete your 2UFi Passport—your digital business profile.

- Once verified, click “Open an Account” on your dashboard to activate your 2UFi Business Suite and start earning automatically.

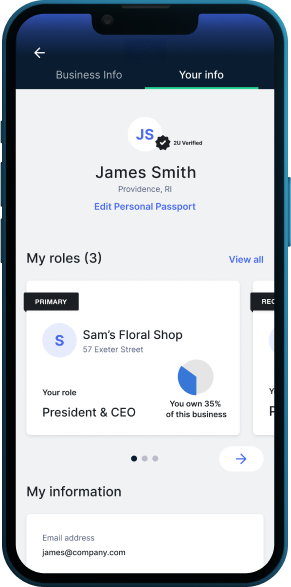

What is a 2UFi Passport?

Your 2UFi Passport is your secure, all-in-one profile that holds your personal and business information. You’ll set it up when you first create your account by entering details like your name, business information, and verification documents. Once your Passport is complete, 2UFi uses it to pre-fill applications, streamline approvals, and give you quick access to all of your 2U Business Suite features.

What is my digital business profile?

Your digital business profile is the business portion of your 2UFi Passport. It includes your business name, EIN, address, NAICS code, ownership details, and other information required to verify your company. Creating this profile helps 2UFi confirm your business identity and ensures your account is set up correctly. Once it’s complete, opening your 2U Business Suite account is much faster because your information is already stored and ready to go.

What information do I need to open an account?

To avoid delays, have this information ready before you start:

- Business details: EIN, legal business address, NAICS code, website (if available), and phone number

- Personal details: SSN, home address, and a valid government-issued ID

How long does approval take?

Once your documents are verified, you’ll usually get approval within a few business days. If we need extra information to confirm business ownership or roles, the process may take a little longer.

Account access and security

Is my information safe with 2UFi?

Absolutely. 2UFi uses advanced encryption and verification protocols to protect your personal and business data at every step of the process.

Can I manage my account from my phone?

Yes. You can easily access your 2UFi Business Suite through the 2UFi mobile app or desktop dashboard—view balances, track earnings, transfer funds, and more, anytime.

Getting started

Where do I start?

You can download the 2UFi app from your device’s app store or visit app.2Ufi.com to get started. Follow the prompts to set up your 2UFi Passport and unlock automatic earnings with the 2UFi Business Suite.

*APY is accurate as of February 3, 2026. Rates are variable and subject to change without notice. APY is only applicable to the amount of funds transferred nightly and returned to thespending account each morning. Only daily amounts in excess of $5,000 are eligible for transfer to savings.

** No paper checks

*** 2UniFi, LLC, is a financial technology company, not a FDIC-insured bank. Banking and lending products and services are provided by Bank of Jackson Hole Trust, Member FDIC. Deposit insurance covers the failure of an insured bank.

The 2UFi VISA® Business Debit Card is issued by the Bank of Jackson Hole Trust pursuant to a license from VISA U.S.A., Inc.

2UniFi, 2U, and 2UFi are service marks of 2UniFi, LLC. ©2026 2UniFi, LLC. All other company names and brands are the property of their respective owner.